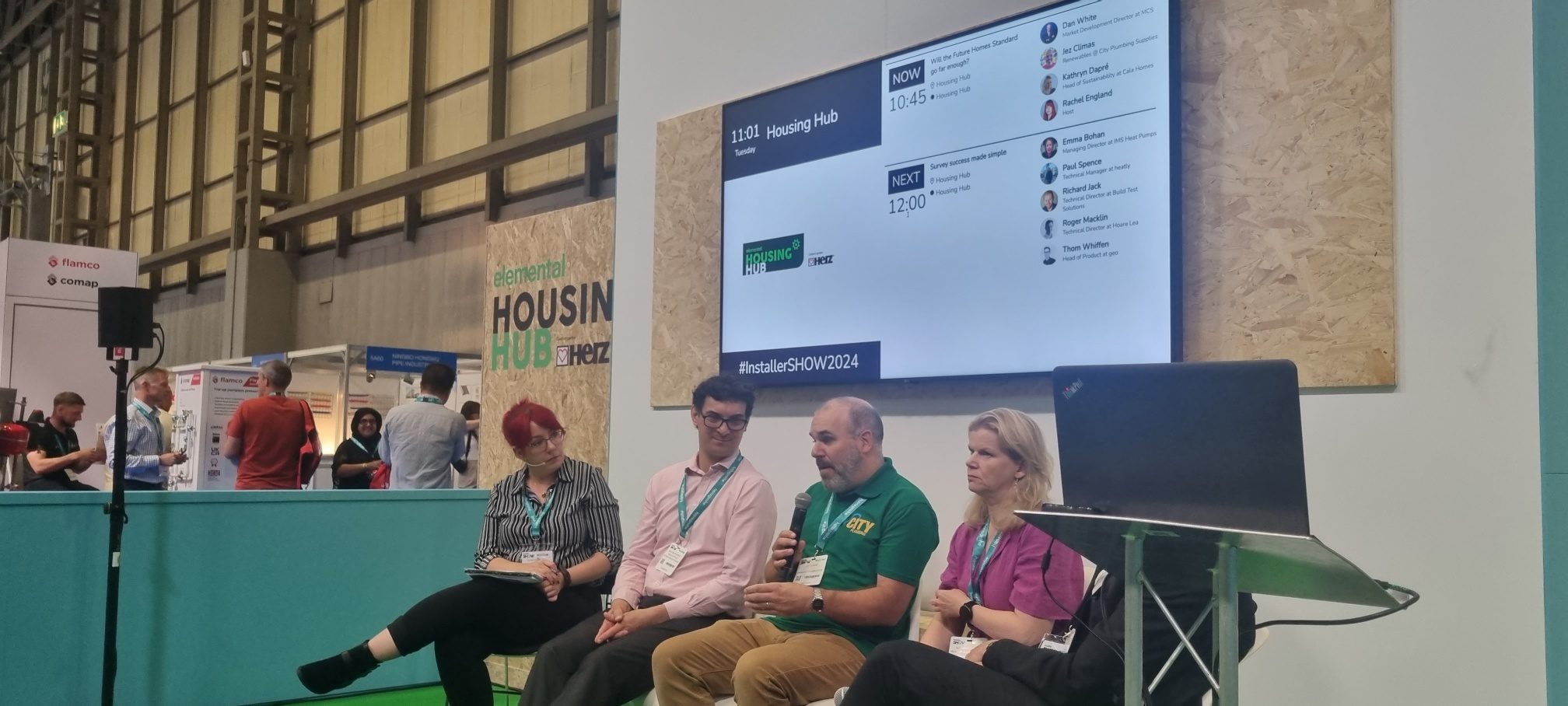

We attended the Installer Show at the NEC last week. It is a superb way to catch up with many faces from across the plumbing, heating and bathroom sector. But it is also a good way to hear from industry leaders via a range of panel discussions, keynote talks, and interactive seminars.

Dave attended a particularly pertinent session on Tuesday titled ‘Will the Future Homes Standard go far enough?’. This was a panel session including representatives from Cala Homes, City Plumbing, MCS (Microgeneration Certification Scheme) and FMB.

This Eureka long-read outlines what the Future Home Standard (FHS) actually is and the timeline for the roll-out. We also reflect on some of the discussion around the challenges that the policy implies and make some links to current and past research work that Eureka has been involved in. So firstly, onto some of the basics.

What is the Future Homes Standard?

As a key part of the UK’s journey to Net Zero by 2050, the housing industry is on the cusp of a significant transformation. The FHS, set for introduction in England in 2025, sets a new framework for the new build sector which prioritises energy efficiency, low-carbon heating, and near-zero carbon emissions.

The FHS aims for a dramatic reduction in carbon emissions from new homes, targeting a 75%-80% decrease compared to current standards. Making all new homes ‘Net Zero ready’, will be achieved through a multi-pronged approach:

- Super Insulation. More enhanced building fabric with high insulation levels will drastically reduce heat loss, minimizing energy demands.

- Low-Carbon Heating Systems. Traditional gas boilers that we are all familiar with will be phased out. The consultation documents (see below) work on the assumption that gas boilers will not meet the proposed standards. Renewable heating solutions like heat pumps and solar thermal panels have to be the future.

- Renewable Energy Integration. New builds will be designed to readily integrate future renewable energy sources like solar PV panels, creating truly zero-carbon homes when the grid itself decarbonizes. There was a lot of debate in the session about the need for greater planning and energy grid reform.

- Smart Technology Integration. Smart controls and monitoring systems will also optimize energy use and improve overall home efficiency.

The Future Homes Standard Consultation

The Government opened a formal consultation period for the FHS between December 2023 and March 2024. This period allowed stakeholders, including housebuilders, industry experts, and environmental groups, to provide feedback on the proposed regulations and provide evidence. The consultation related to England only.

There was plenty of bedtime reading in the consultation which included a total of 40 documents and 90 questions related to new homes and non-domestic buildings. Some key theme to emerge from the consultation included timings, overheating and HEM.

The Consultation key themes

Transitional Arrangements. The government explored two options for a transitional period between the laying of the FHS legislation and its implementation. These options offered either a 6-month or 12-month grace period for housebuilders to adjust to the new standards, followed by an additional 12-month transitional period.The final decision on transitional arrangements will likely be influenced by the feedback received during the consultation. The panel expressed some frustrations with the roll-out; it now looks likely that policy will not be mandated until the turn of 2025 which means that it will be 2026 when these new homes are actually sold.

Overheating Risks. The consultation also addressed concerns about potential overheating in highly energy-efficient homes. Stakeholders were invited to share their experiences and propose solutions for mitigating this risk while maintaining the FHS’s core goals of energy efficiency and low carbon emissions. The panel agreed that looking at ventilation and heat comfort (in conjunction with fabric improvements) was very sensible and helps the industry to manage any unintended consequences that could emerge with such an uplift in energy efficient homes.

And time for a new acronym! The consultation also explored a new calculation methodology called Home Energy Model (HEM). This will potentially replace the Standard Assessment Procedure (SAP) which has generally been considered the de facto way of rating energy efficiency to date. Feedback on the user-friendliness and accuracy of the HEM will be crucial for ensuring a smooth implementation of the FHS. The panel discussed that big builders will have the resources to bring in specialists for this – but this is a bigger challenge for the SME sector.

The outcome of the consultation is still awaited with bated breath. However, the government’s consideration of industry feedback suggests a commitment to a collaborative approach in shaping the final form of the FHS. Housebuilders who actively participated in the consultation can rightly expect to benefit from a regulatory framework that addresses their concerns and allows for a smoother transition to the new standards.

Surprise news for solar panels

All new homes will be required to have much higher fabric standards and use low-carbon heating systems, such as air-source heat pumps. For blocks of flats and apartments, the preferred heating system is likely to be a fourth-generation heat network that uses air-source heat pumps.

Even hybrid heat pumps, hydrogen-ready boilers and biofuel systems are not expected to meet the standard. The policy appears to ignore air-to-air heat pumps entirely, which some of the panel argued are the most efficient and offer tremendous opportunity.

Now for the shock aspect. Many in the house building industry expected PV panels to feature highly in the Future Homes Standard proposals. In a bit of a ‘turn up for the books’, the document states however that solar makes a relatively small contribution to the carbon savings of individual homes compared to the switch to low-carbon heating. The policy appears to propose one option with solar panels and one without.

Organisations such as the MCS believe that this is bit of a wasted opportunity. Solar export tariffs are improving all the time. See OFGEM figures here.

The evidence in Scotland has also been interesting. Even though there was a realisation north of the border that heat pumps would probably mean solar was not required, homebuilders found that consumers often turn up expecting to see PV in new builds. The panel discussed how PV is not a big cost in relative terms but is very visible to potential purchasers and the technology is now very ‘normalised’. How do we achieve that same level of normalisation with heat pumps? Feels like some behaviour change research is required here!

Challenges and considerations for housebuilders

Although the FHS does presents a significant shift for the construction industry in England, members of the panel did express a wider viewpoint of ‘Is that it?’. Most working in the sector already knew that a push towards electrification was coming and bigger construction brands have been working on plans to work without gas for a while.

Although it does sound a bit strange to hear an industry shout for MORE regulation, there is a bit of a feeling that the policy direction is not strong or ambitious enough. It is already an uneven playing field in the sense that some builders cling on to the weakest level of regulations – a somewhat controversial practice as highlighted by this Guardian article last year. Cala Homes already note that some local authorities (even in England) are already expecting to see developments that surpass the current basic regulations and make Zero Carbon fund contribution payments.

The apparent lean towards heat pumps discussed above presents some very specific challenges too. Housebuilders will need to adapt their practices in several key areas:

- Upskilling the workforce. Construction teams will need training on new technologies like heat pumps and smart systems. Current figures suggest just 18% of installers are actively working with heat pumps and only 6% are MCS certified.

- Supply chain management. Sourcing low-carbon building materials and readily integrating renewable energy solutions will require establishing new partnerships and adapting supply chains.

- Potential cost increases. While the FHS prioritizes long-term cost savings through reduced energy bills, the initial investment in new technologies and construction methods may lead to higher upfront costs.

- Design innovation. Creating aesthetically pleasing and functional homes that meet the FHS’s stringent efficiency standards will require innovative design solutions.

If you have a responsibility for understanding how potential new build customers are thinking then do please get in touch.

A patchwork of regulations

While this presents exciting possibilities for homeowners, housebuilders need to be prepared for the challenges and opportunities the FHS brings. However, the picture across the UK isn’t entirely uniform. Scotland, for example, has already implemented its own set of regulations with a 2040 Net Zero target. There is a need for a nuanced understanding of the regulatory landscape.

Here’s a brief overview:

- Scotland – The Scottish Government introduced stricter energy efficiency standards in 2022, requiring all new homes to achieve a 75% reduction in CO2 emissions compared to 2017 standards. This is achieved through similar principles as the FHS, with a focus on low-carbon heating and improved building fabric performance.

- Wales – The Welsh Government has also set ambitious targets for decarbonizing the built environment. Their “Nearly Zero Energy Buildings” standard is slated to come into effect in 2025, aligning with the FHS timeline. However, specific details regarding the technical requirements are still under development.

- Northern Ireland – Northern Ireland is currently operating under Part F of the Building Regulations, which focuses on conserving fuel and power in new buildings. While not as stringent as the FHS, there are ongoing discussions about aligning regulations with the rest of the UK in the future.

The panel also discussed that there will also be a local authority level challenge when we do have the new legislation. There may still be variations between different LAs due to different interpretations of policy alongside local Design Guides. Construction businesses ultimately just want certainty and lots of geographical variations are not particularly conducive to a smooth-running house building sector.

Market research: a key tool for housebuilders in a changing policy landscape

While the FHS presents challenges, robust market research can help housebuilders navigate this transition and capitalize on the opportunities it presents, even with the varying regulations across the UK. We are currently helping Taylor Wimpey evaluate some of their experimental home designs in Sudbury, where five trial prototype homes have been developed to showcase possible solutions for the industry. More information about what this major builder are doing is here.

Here are some Eureka thoughts on possible research exercises for other housebuilders seeking to get closer to their prospective future purchasers:

- Understanding consumer preferences – Research can reveal consumer attitudes towards sustainable living and their willingness to pay a premium for energy-efficient homes. This can guide housebuilders in developing FHS-compliant properties that resonate with the marketplace.

- Identifying regional variations – Consumer preferences and energy demands can vary across regions. Market research can help housebuilders tailor their FHS implementation strategies to suit specific regional needs, even if the overarching regulations are similar across England, Wales, and potentially Northern Ireland in the future. In Scotland, for example, research can help identify how best to differentiate offerings within the existing regulatory framework.

- Gauging future trends – Researching emerging technologies and consumer trends in renewable energy can help housebuilders stay ahead of the curve and choose future-proof solutions for FHS-compliant homes. This applies equally across the UK, ensuring adaptability regardless of specific regional regulations.

- Consumer confidence – Have potential purchasers even heard of MCS accreditation – if not, what else would give them confidence to adopt?

- Understanding competitor strategies – Analyzing how other builders are approaching the FHS, or their own regional regulations, can help housebuilders identify potential gaps in the market and differentiate their offerings.

More information about Future Homes Standard

Overview from Inside Housing

Taylor Wimpey trial we are evaluating:

Another model being trialled in the sector

Social housing example

For more information about Eureka’s work with builders in the construction sector please click here.