A few weeks ago, Screwfix announced that they will no longer be printing physical copies of its catalogue, instead introducing digital screens in store showing its full 37,000 product range, compared to just 16,000 that were in the catalogue.

In a nod to the potential enormity of this business decision, the CEO admitted in his press release comments “Our iconic catalogue has been a huge part a part of our brand identity for the past 30 years”. It certainly feels like a symbolic moment.

Co-incidentally or otherwise, within days, Toolstation appear to have doubled down on their commitment to paper by launching their latest trade catalogue. Other national merchants meanwhile have been continuing to invest in their digital offer, such as Selco.

Perhaps only time will tell which retailer is more in tune with their core trade audience? To provide some guidance in the meantime, we have conducted some research on this topic.

Channel preference – Quick poll results

Since launching Eureka! over 5 years ago, we have often explored this issue in relation to a specific category or setting. We have frequently sat with tradespeople in their vans, observing how they use their set of much-loved brochures, what obstacles they face and how a strong online offer can add value. We have also tested new e-commerce offers for national merchants and online reward portals for major supplier brands.

The consistent thread running through all this insight is a thirst to understand how best to put information easily and readily in the hands of busy tradespeople. To provide some broader illumination on this topic, this August we conducted our own quick poll to get to the bottom of the matter.

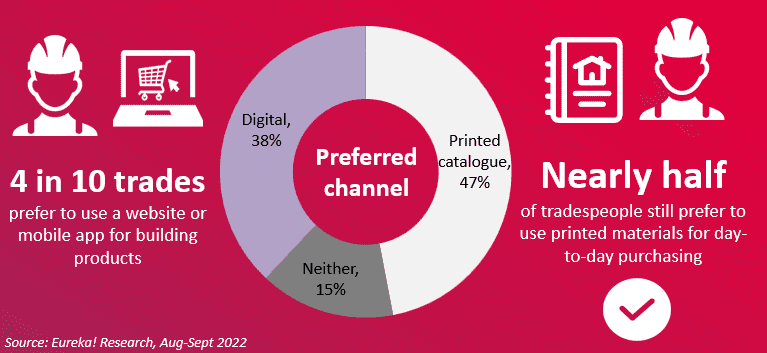

The result indicated that this is a very polarised topic. Although nearly half of the tradespeople we interviewed in August indicated that they still prefer a more traditional approach, nearly 4 in 10 said that they were adopting a more digital-first approach.

Our question asked: Given the choice, how do you prefer to read/browse for the building products you need day-to-day? The wording was adapted slightly depending on the type of tradesperson being surveyed – for instance plumbers were asked about their everyday plumbing and bathroom requirements.

The results from our quick poll of 108 tradespeople show the following preferences:

- Printed catalogue / brochure (47%)

- Website / mobile app (38%)

- Neither – order directly at the merchant counter (15%)

Canny readers will also note that we deliberately forced the respondent to make a simple choice – our desire was to elicit an instant, spontaneous preference. We understand that in the real world of being on the tools, tradespeople will be using a combination of material sources – depending on whether they are with the customer, at the merchant or showroom, or even in the van.

Purchasing day to day building products

Note the deliberate emphasis on day-to-day products in our question here – this could include heavy or light-side sundry items as well as higher-ticket items for customers such as boilers, lighting, kitchen, or bathroom sanitaryware. We are in no doubt that more considered purchases would necessitate a different choice of information sources, some of which might be shared collaboratively with the end customer.

Interestingly, over 1 in 7 tradespeople said that they were agnostic towards paper or digital – and still prefer to order face to face at the counter. This is great news for merchants and other retailers who still place a high value on ensuring their staff are knowledgeable and deliver the friendly service that their trade customers enjoy.

A data nerd observation here too. If we are being super-scientific, it is worth observing that this insight was collected via an online survey methodology. If we had also collected answers face to face in-merchant or elsewhere, then it’s likely that we might have had even more respondents endorse the traditional (paper or face to face) channels.

One size does not fit all

Overall what is clear to us here is that to successfully engage with all parts of the trade, a multi-channel approach is still required. Although based on a modest sample, we think this free research should provide some pause for thought to retailers and brands who are considering ditching paper-based literature entirely.

Some observers might say that there is simply a generational effect here – and all younger trades will want a digital-only experience now and into the future. Examining our results further suggests that there is actually not a rudimentary age pattern to this; indeed channel preference is obviously quite an individualistic choice.

We believe that channel preference is probably also more linked to business set-up and how sophisticated buying and procurement processes are in reality. For instance, our quick poll hints at some important differences according to turnover. The preference for traditional catalogues appears to be higher amongst smaller businesses:

- Low turnover/sole traders – Print (57%) vs Digital (36%)

- Higher turnover – Print (45%) vs Digital (42%)

As ever therefore, it might be wise to consider a more nuanced strategy, starting with a thorough understanding of target audience composition and behaviour.

No room for sentiment?

Only time will tell whether the Screwfix decision is seen as a masterstroke. The brand started in 1979 as a mail order company before investing in bricks and mortar stores from 2005. They now want to focus on their digital offering across its app, website, and in store order points. It might be said they are simply moving with the times.

The closest consumer comparison that comes to our mind is the Argos catalogue. In 2020, they announced they were ceasing to print their iconic catalogue. The catalogue was first launched in 1972 and at its peak was Europe’s most widely-printed publication, with only the Bible in more homes across the UK, according to the BBC.

Interestingly, and perhaps as a final word of warning to trade brands considering going completely ”one way or the other”, Argos have committed to still produce a print version of its annual Christmas gift guide.

No doubt there is a lot more to channel preference than meets the eye here. We recognise that this is quick survey and is based on a modest sample size and would benefit from deeper exploration. If you are a brand that would like to explore your particular category in more detail, do please get in touch for a discussion about how we could do this together!

If you would like to see more of our in-depth research with the trade, you can browse much more completely for free here

References