The dust is now finally settling on the most ambitious study ever undertaken with independent retailers across the UK kitchen, bedroom and bathroom industry. Conducted on behalf of KBB Review, the leading business magazine in the KBB retailer sector, and supported by Hettich, a major supplier, this comprehensive piece of thought leadership is proving to be a valuable resource to the sector through 2024 and beyond.

Creating a genuine splash with the results

Every two years, to mark the build-up to kbb Birmingham, the guys at Taylist Media conduct research with their independent KBB retailer audience to extract their views on the state of the industry, business confidence and key topical issues.

This time around, they asked us to help them take the campaign up a notch – and we were up for the challenge! Working collaboratively on the approach and bringing some new engagement techniques to the table, allowed us to secure a whopping 500 interviews with retailers who are notoriously time-poor (an uplift of well over 200% on previous iterations).

The outcome of all this hard work has quickly become the must-read ‘state of the nation’ piece for anyone operating in the KBB retail sector. The project has also become an excellent example of how to feedback key insights to the retail community itself and gain maximise exposure for the project and sponsor, Hettich UK. Since the end of fieldwork and delivery of results, the following coverage has been released to the market. Check all this out:

- Front page splash – January 2024 edition of KBBReview

- 6 pages of detailed analysis in the print edition, including quick fire feedback from Simeon Gabriel, MD at Hettich UK

- Two-part podcast released in February 2024, enabling Andy to cross-reference the findings from retailers themselves, specifically Lima Kitchens (Milton Keynes), Luck & Fuller (Billericay) and Gainsborough Kitchens (Lincolnshire)

- A more detailed six part analysis of the results online with further vox-pops from retailers on the coalface

- Cross-over content in article ahead of Installer Show to be held June 2024

- Follow up analysis by our very own Dave Ruston, published in print and online March KBBReview edition

Further exploration of the KBB retailer results

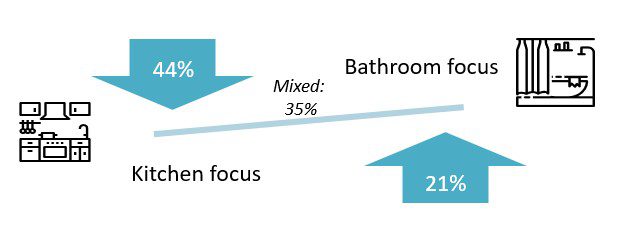

Having such a comprehensive survey – coupled with a fantastic response rate – provides plenty of data-mining and insight gathering opportunities! One of the first things to say is that businesses across the KBB retailer landscape are extremely varied. There is not a one size-fits-all. Both in terms of business size and specialism. In the image below, we can see overall that the industry tends to lean towards the kitchen side of things (44% of respondents to our survey) but over one-third have a mixed retail offering and showroom.

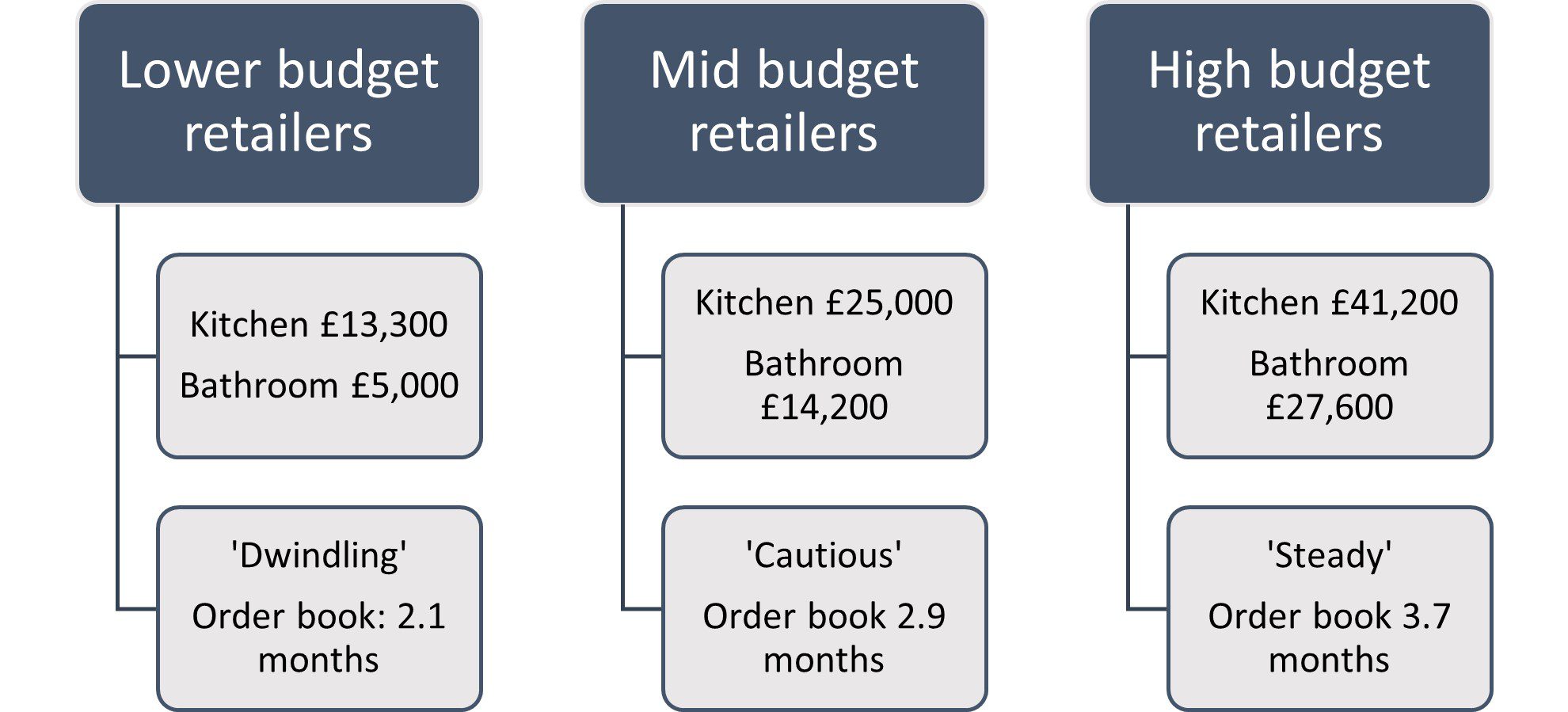

It is also quite clear that the sector is currently working at variable speeds – and this is particularly evident when we look at retailers operating at different ends of the budget spectrum. As the graphic below shows, we have defined the market according to three categories. This of course still masks some huge variations – such as the 4% of niche, exclusive showrooms who told us their average fully managed project has a value of £50k or more – but it’s a starting point for taking a more nuanced look at the industry.

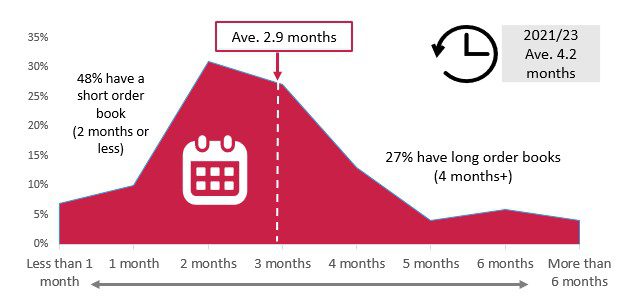

Retailers at the higher end of the market are generally feeling a bit more optimistic about things on a wide array of measures. Although over half of all retailers say their leads are down across the board, twice as many higher-end retailers (25%) report having more enquiries than a year ago, compared with those operating at the lower budget end (13%). The average order book for a KBB retailer now sits at 2.9 months.

Although conversion rates are typically consistent across most KBB retailers (about 60% of enquiries convert on average), there are some big differences in confirmed orders and therefore business confidence. Lower budget retailers told us they now have an order book of 2.1 months, compared with higher end retailers who have 3.7 months of confirmed projects in the calendar.

The rate of economic slowdown is certainly more pronounced at the lower budget end of the market. 44% of these retailers said that their order books were now worse than 12 months ago (36% of higher budget retailers reported this). In fact, one fifth of high-end retailers said their order book had improved compared to a year ago (21%).

Consumer confidence and the property market

Business confidence can be a fragile thing. And, in this sector, it is invariably linked to consumer sentiment. Let’s also keep in mind the health of the broader property market is also a well-known barometer of big-ticket home improvement purchases.

Two thirds of KBB retailers in both the mid and high budget brackets (67%) agreed that property market uncertainty and the wider economic backdrop are their biggest business challenges. 52% also suggested that potential clients are taking longer in their decision-making, which perhaps reflects an underlying level of caution in the market.

Lower budget retailers were more likely to tell us that inflationary operating costs (57%) are causing them headaches and the threat of being undercut by online retail (50%) continues to be a significant threat to retailers at this end of the market. Just 30% of higher-end retailers said ecommerce was a big challenge (in fact just 8% see it as their most significant threat).

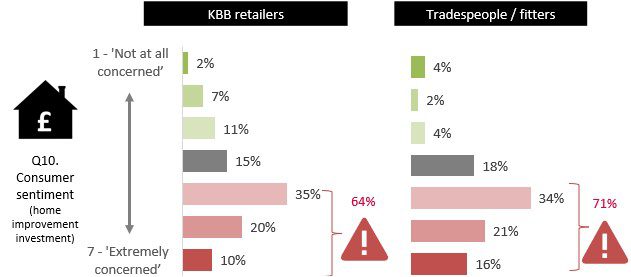

Against the backdrop of the continuing cost of living crisis, around two-thirds (64%) of KBB retailers say they are concerned about the impact of this on future household spending. Confidence is clearly fragile amongst the retailers at the low-end of the market where this rises to 73%. In contrast, higher-end retailers are more bullish about the future – 58% of these say they are concerned; one quarter claim that they are not concerned at all!

As the chart below illustrates, this also chimes with the tradespeople and installers we regularly engage with too. Over 7 in 10 installers were concerned about consumer demand when we polled them in Autumn 2023. We have plenty of other data about insight about tradespeople who install product in this sector – if you are interested check these full reports out.

Getting battle-ready: is the KBB retailer getting prepared?

A challenging 2024? You bet. Regardless of business positioning, most retailers said they were getting ‘battle-ready’ for a difficult year ahead. In terms of staffing, retailers at the higher budget end appear to be particularly upbeat. 26% of these business report taking on a new member of staff recently, and 22% have plans for new staff soon. A KBB retailer at the lower-end is simply seeking stability – two-thirds say their staffing situation is unchanged and only 8% have let employees go.

Higher end retailers have more available budget to increase their marketing activity – 75% said they were ramping up their marketing spend to mitigate market challenges – only half of lower-end retailers said they were able to do this.

Lower budget retailers are more likely to be adopting a strategy of increasing prices (32%) and expanding the range of suppliers they deal with (37%). Just 9% of KBB retailers rate the overall support they get from suppliers as excellent which illustrates a high level of potential for switching.

Whilst better service levels are the main thing that would encourage any retailer to switch, there is also a thirst for more innovative products. Over one-third said that a more innovative offer would encourage them to switch suppliers; this is particularly attractive to higher budget retailers (47%). Suppliers, you have been warned!

Interested in learning more?

Want to know more? If you would like more information about how we can help you better understand your retail channel – and what a ‘typical’ KBB retailer needs – get in touch with Eureka! here.