You may have already read our recent report At the cliff edge, which laid bear some of the challenges faced by tradespeople regarding staffing, apprenticeships, and the wider confidence levels of homeowners. Our report was undoubtedly a difficult read for many in the sector as we attempted to bring these issues back to the fore of policy makers agendas. Supported by our friends at the BIKBBI, it’s a revealing read that we encourage you to consume.

In this most recent blog, we are again focusing on the tradesperson and looking into ways to help ensure their offer is aligned with the homeowners needs. For this, we are dipping into the data from our recent dual pronged research study where we undertook two similarly themed consultations – one with homeowners and one with tradespeople (our first blog using this data revealed some of the worries and concerns that invade homeowner minds when considering appointing a tradesperson, find it here).

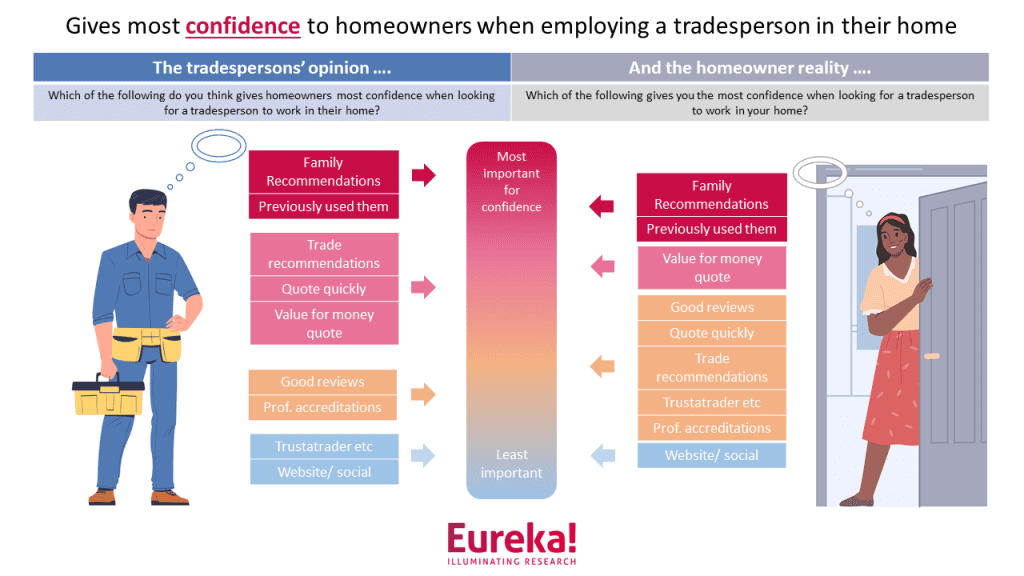

What gives homeowners most confidence when appointing a tradesperson?

Tradespeople and homeowners are very closely aligned concerning the greatest confidence inspiring initiatives when seeking a tradesperson; both highlight family recommendations and the surety of previously using a specific tradesperson. The importance of trust and recommendation trends upwards as people get older. Obviously, a customer that trusts you is more likely to recommend you to their friends, family or work colleagues too and so the cycle continues. Building this lifetime of trust and loyalty is the holy grail for tradespeople; once trust is broken it can be incredibly hard to rebuild.

While the trade highlights their perceived importance surrounding peer recommendations and a speedy and value for money quote, homeowners are not as wedded to all of these, and only identify a value for money quote as being in the second tier of importance, and this focus on value is more keenly felt by the youngest audiences. Clearly for homeowners, other trade sector recommendations are not as valuable/ readily sought, and speed is less of the essence for them regarding quotes, its more about value for money; two areas of consideration for the trade.

While the trade highlights their perceived importance surrounding peer recommendations and a speedy and value for money quote, homeowners are not as wedded to all of these, and only identify a value for money quote as being in the second tier of importance, and this focus on value is more keenly felt by the youngest audiences. Clearly for homeowners, other trade sector recommendations are not as valuable/ readily sought, and speed is less of the essence for them regarding quotes, its more about value for money; two areas of consideration for the trade.

Confidence builders such as good reviews and professional accreditations are equally valued by both audiences, but interestingly, the homeowner does place more emphasis on Trustatrader type websites than the tradesperson perceives (although still at a modest level of importance overall – read our previous research report here regarding the future of finding tradespeople). Both place little importance on a tradesperson’s website/ social visibility, although unsurprisingly this is significantly higher with the younger homeowners.

It is positive to already see that tradespeople are so closely aligned to the needs of homeowners and therefore can continue to deliver a service that meets and even exceeds the homeowner’s’ expectations.

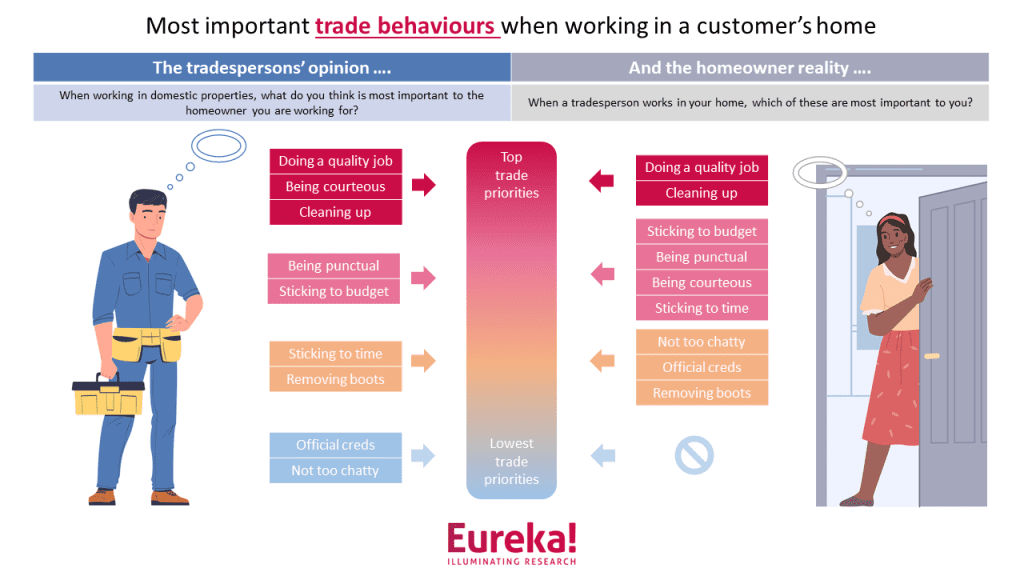

Most important trade behaviours

What about when a tradesperson is actually working in the house? What are the key behavioural traits that homeowners need and how does the tradepersons expectations measure up against these?

Doing a quality job and cleaning up afterwards are the two highest trade priorities identified by homeowners. While the need for quality pervades all customer types, the requirement to leave a tidy workspace is definitely one that resonates most strongly with the older age groups. While trades place courtesy as a top-level homeowner need, in fact, homeowners place this into the second tier of requirements (that’s not to say we shouldn’t be polite and courteous to all customers, just an interesting observation of priorities!).

Below this, it is clear that homeowners place a more elevated need on a number of behaviours compared to the trade, such as ‘sticking to the timeline’, and the related ‘not being too chatty/ getting on with it’. Homeowners do not place any of these priorities in the lowest section however, reflective of their need for lots of these boxes being ticked.

The extent of these needs is certainly in evidence when we look across the age ranges; the older age categories are identifying far more expected behaviours compared to the younger cohort (on average 6 versus 3), clearly a more demanding audience to satisfy.

We meet hundreds of tradespeople in our line of work and are always impressed with their entrepreneurship, ingenuity and personability. We know that the overwhelming majority are clued up on these issues, but it’s always nice to sound a little reminder to our favourite trades!

Methodological note

We have our own highly engaged community of tradespeople that we use for both client projects and our own research (such as this). This is made up of a variety of sole traders, contractors, and small businesses (across many trades) who we can turn to when we need both quick and longer-term research commitments. Take a look here for more information.

Both surveys were conducted online during October 2023 by Eureka! Research. 250 interviews were completed with both tradespeople and homeowner audiences.

For more information about Eureka’s work in the home improvement space please click here.