So finally there is a touch of Spring in the air. It won’t be long until DIY sheds and garden centres start to see the annual pilgrimage of homeowners looking for inspiration to kick-start their maintenance and improvement tasks for the year ahead. Certainly, retailers will be hoping for a bumper start to the year.

And some of the recent financial results published by DIY and merchant channels suggest reasonable levels of sales already this year; a mixed picture overall but some cause for optimism perhaps.

Amongst others, GFK continue to indicate that the financial pulse of the nation is still very weak. Wages are not keeping pace with surging prices. House prices have peaked. Rises in the ‘Savings Index’ also suggests that consumers are choosing to put any spare money to one side rather than purchase high ticket items.

Against the wider backdrop of the cost-of-living crisis then – and with no sign of the forecasted fall in inflation yet – we wanted to check whether UK consumers are actually reigning in their expenditure plans for home improvements this year. We know that spending directly on DIY materials can be somewhat discretionary, so our measure asks about projects and maintenance tasks where a professional tradesperson will be required.

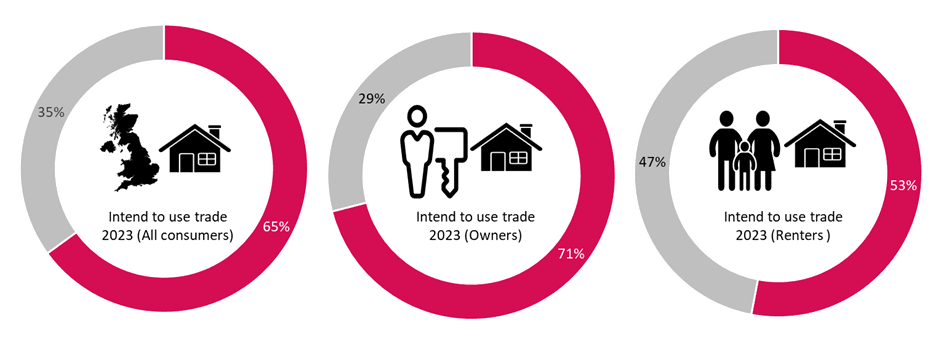

Number of households planning work to their property this year

The sector can take some reassurance from the fact that overall two-thirds of households are planning work that will require paying at least one tradesperson in 2023. Unsurprisingly, the proportion of home owners expecting to use the services of a tradespeople is higher (71%) compared to those who are in the private and social renter sectors (53%).

This is a particularly pleasing result as the general sentiment at the start of 2023 was that a very challenging year awaited us. And demand would certainly be no where near the home improvement boom seem since the pandemic, where Eureka were measuring record order books and lead-time for consumers.

Which brands will face the biggest challenges this year?

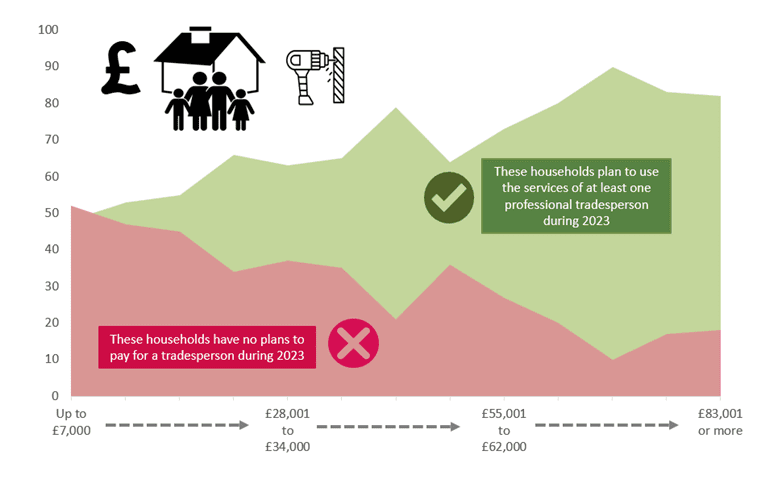

Now onto the bad news. Many commentators have written about the uneven impact of the economic squeeze. This has led to some speculating that there are many consumer realities and that some parts of a market might appear buoyant – with persistent demand for services – whilst others will be dramatically squeezed as households are forced to tighten their belts.

We certainly believe that different parts of the RMI market are operating at different speeds. In the context of the home improvement sector, this could result in a real squeeze on brands who position themselves in the ‘middle ground’ on their category. Growth is more likely to come from those buying at the premium end of the market, or those looking for good value for money at the other end of the spectrum.

Our data indicate that a strong correlation exists between household income and intention to use the services of professional tradespeople. But look how ‘bumpy’ the landscape is. We can see very clearly that around one half of the poorest households in the UK have no intention of using a trade this year. This could result in delayed purchasing/maintenance, full deferment, or perhaps seeking alternative solutions (including DIY).

At the other end of the income distribution, around 8 in 10 higher earners intend to bring a professional trade into their home at some point during this year; suggesting a very strong year ahead for those positioning themselves at that end of the category.

Which trades are likely to be busiest in 2023?

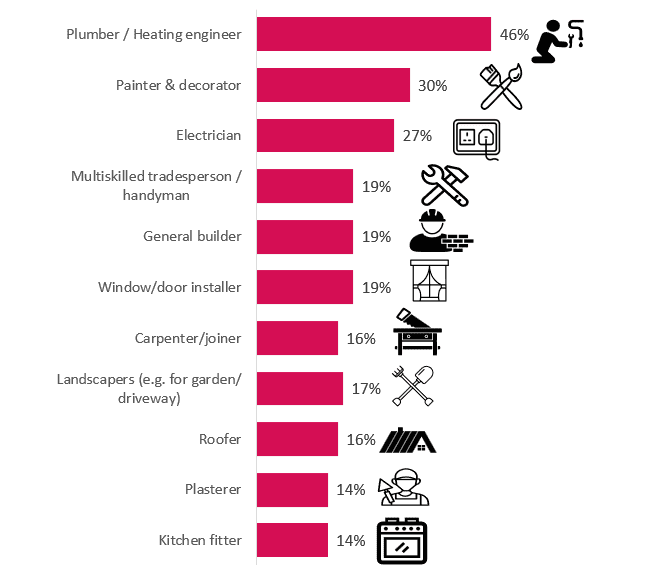

Are certain tradespeople likely to see more enquiries than others this year? Further analysis of our data indicates which trades are most likely to be in demand during 2023. Of the homeowners who confirmed they are planning work, the most frequently trades mentioned are:

- Plumber/heating engineer (46%)

- Painter & decorator (30%)

- Electrician (27%)

So plumbers & heating engineers top the list of tradespeople required in 2023. Of course, this is likely to cover a range of routine maintenance (e.g. boiler), repairs and larger improvement (bathroom) related projects. Certainly, our work with a range of plumbing and heating brands in recent years indicates a strong and persistent ‘order book’ amongst those who trade in this world.

The full results for all trades can be seen below and we look forward to engaging with many of these tradespeople throughout the year to verify whether these forecasts are accurate. Indeed, we have a really engaged community of tradespeople at Eureka, helping us out with research assignments and entering prize draws for some fantastic trade-related prizes.

More information about our highly active – and rapidly growing – trade community can be seen here

Just a reminder about timing and seasonality

Timing is everything. As researchers we are always conscious of the timing and phasing of the research we undertake and the impact of external factors. Readers should be particularly cautious of seasonal effects – for instance demand for gardening services is likely to be affected by the time of year of research fieldwork. On balance, we think that enquiring about larger household expenditure in this category is more meaningful as we leave the Winter.

Our survey of 970 consumers which forms the basis of this article, was undertaken in mid March 2023 (an online methodology, using appropriate randomisation).

If you would like to see more of our previous in-depth research with the trade, you can browse much more completely for free here

References on this topic

GFK consumer confidence measures

Strong start for garden centres

P&H Merchant Index