Lager has been a staple of the British drinker for many years but it’s only in recent times that we have seen significant disruption to the lager sector with new entrants to the market.

We can all name and recognise the dominate lager brands and production has typically been dominated be them in the UK; foreign producers making lager in the UK under licence, heavily marketed for mass consumption.

However, aligned with the Craft movement in ale, there’s now a much more varied range of lager styles available, with many of them brewed to higher standards, which is helping to open up lager’s appeal to a much wider audience.

So what sort of lagers are piquing the interest of lager drinkers in the UK? We hear about Craft lagers, Sour lagers, Low alcohol lagers etc, but what is the lager drinker aware of and what are they drinking? What are the largest lager drinking trend for consumers?

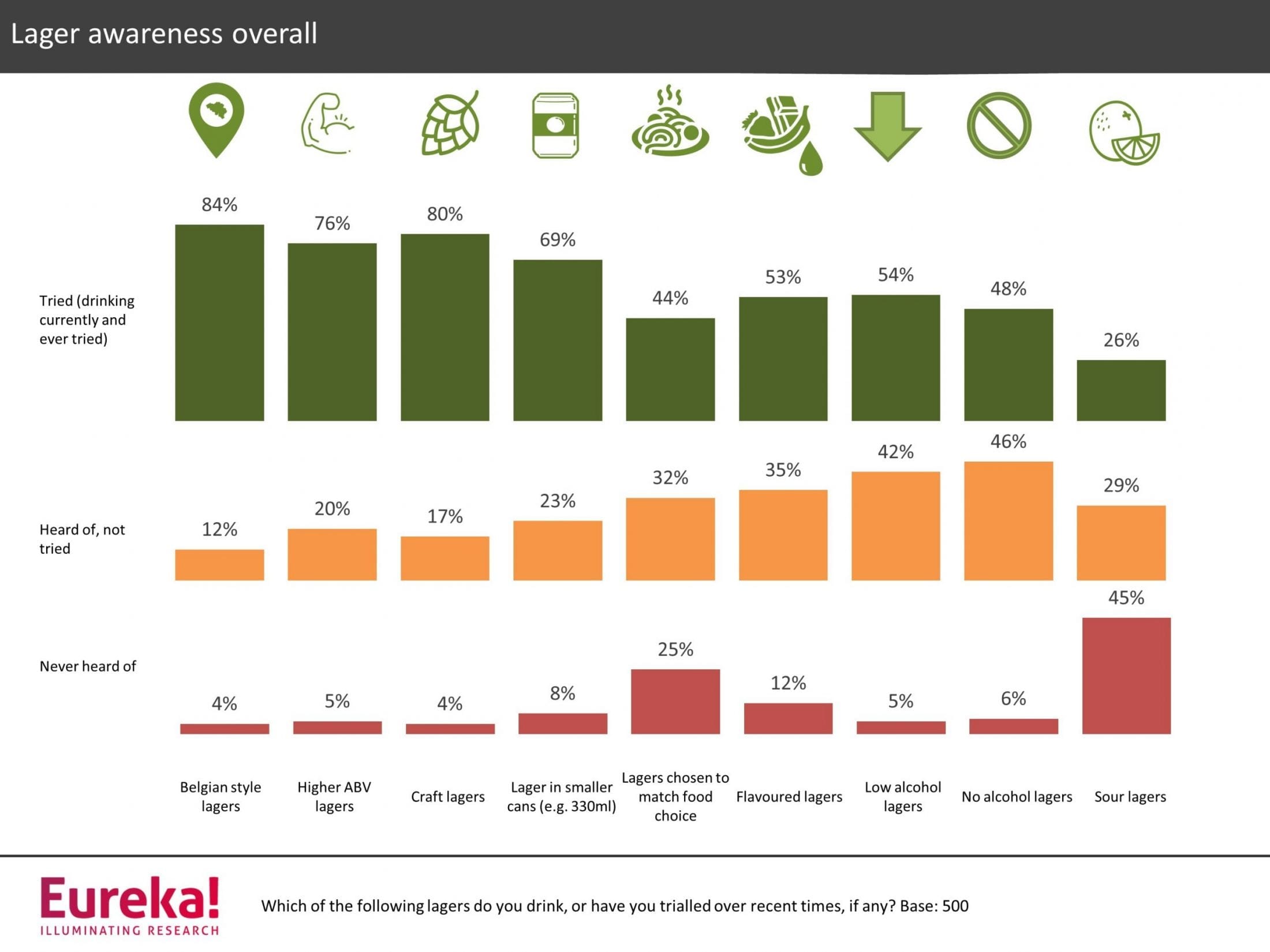

We sought to find out by asking 500 lager drinkers what they have drunk, heard of and never heard of. This was a solid representative sample of UK drinkers. The interviewing was conducted via a unique online survey.

Some of the findings in relation to drinking trends include:

- Belgian style lagers lead the way with over 8 in 10 having ever tried these, followed closely by Craft and higher ABV lagers.

- The trial of Sour lagers is more modest (1 in 4) and a significant proportion state they have never even heard of these lagers.

- Backing up extensive recent press reporting, it is interesting to note that there is significant take-up of low and no alcohol lagers (NABLAB), around half claiming to have drunk these.

- Additionally, with the clear backing of the 330ml can amongst producers and resellers, 7 in 10 state they have drunk lager in this format.

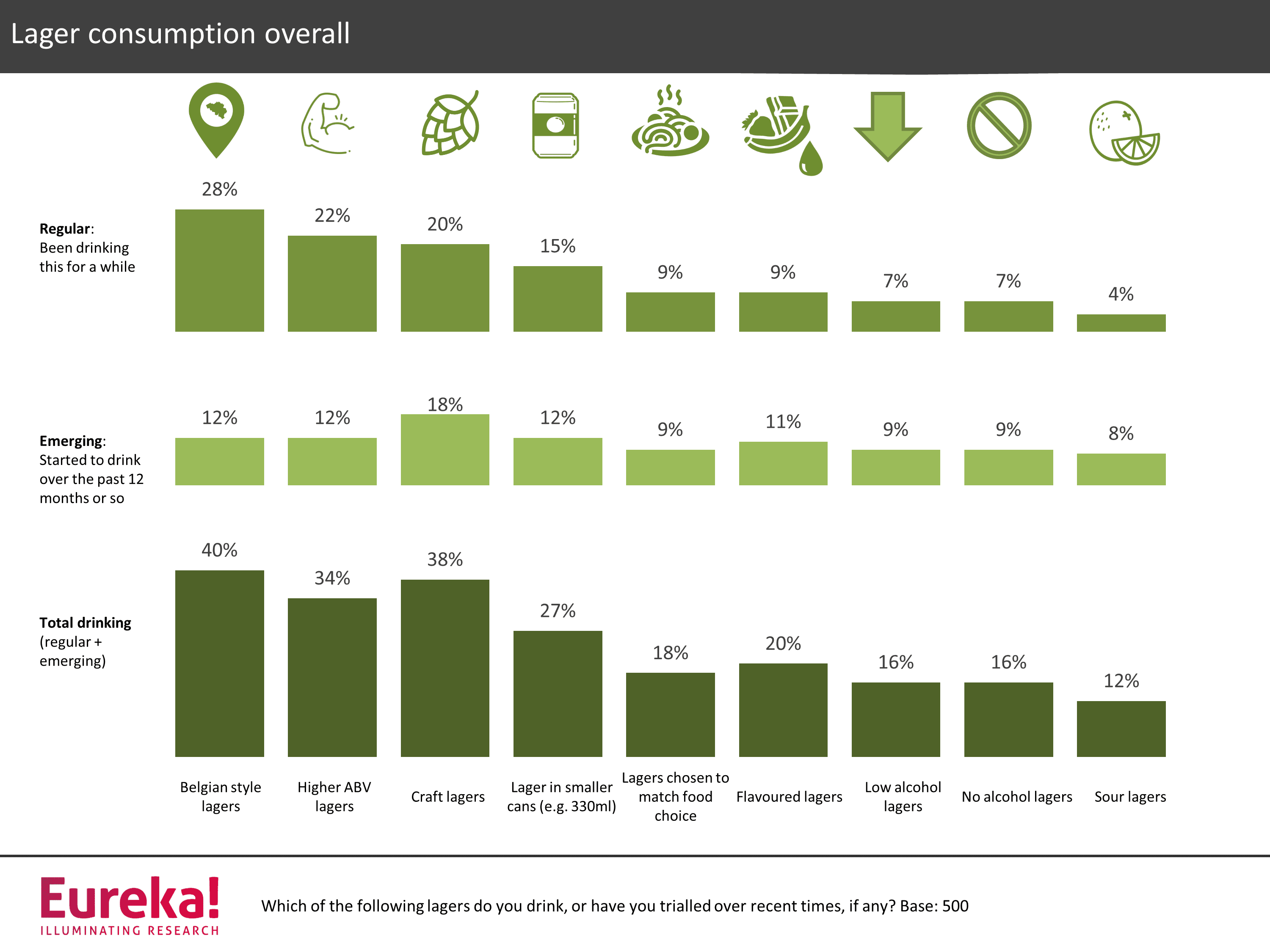

But what about when we separate out the awareness and focus on regular and more recent consumption patterns? Our analysis allows us to do this.

Regular consumption follows similar patterns, but it is interesting to see the strong emergence of Craft lager as a drink that has started to be consumed over the past 12 months; almost 1 in 5 state this. Perhaps unsurprisingly, this increase is strongly fuelled by younger drinkers and those living in the capital.

Although not as obviously strong in terms of the proportion claiming to have recently started drinking, lower alcohol lagers finds clear favour with the health-conscious Millennials, where the proportion recently drinking stands at 15%.

Click here to download the full report on the lager market or here to see our full library of free-to-access research material.

Get in touch if you want to hear more or understand how we may be able to help your business with research in this sector.